Pradhan mantri- jivan bima yojana, suraksha bima yojana, atal pention yojana

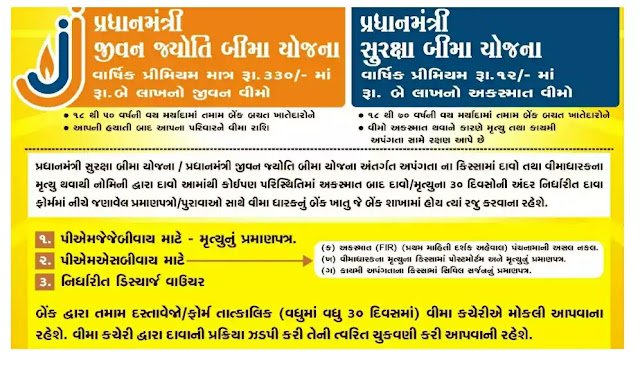

Pradhan Mantri Suraksha Bima Yojana may

be a government-backed accident insurance scheme in India. it had been

originally mentioned within the 2015 Budget speech by minister of

finance Late Arun Jaitley in February 2015. it had been formally

launched by Prime Minister Narendra Modi on 8 May in Kolkata.

This scheme are going to be linked to the bank accounts opened under the

Pradhan Mantri Jan Dhan Yojana scheme. Most of those account had zero

balance initially. the govt aims to scale back the amount of such zero

balance accounts by using this and related schemes. Now all checking

account holders can avail this facility through their net-banking

service facility at any time of the year.

Are higher premiums holding you back from getting your life insurance?

Protect your family's future through SBI Life - Pradhan Mantri Jeevan Jyoti Bima Yojana. Get a life cover of Rs 5 lakh at normal price

Ease - Easy registration and fast processing without any medical tests

Strength - by a nominal premium for all ages

Schedule your family's future today.

1. PRADHAN MANTRI JIVAN BIMA YOJNA.

Are higher premiums holding you back from getting your life insurance?

Protect your family's future through SBI Life - Pradhan Mantri Jeevan Jyoti Bima Yojana. Get a life cover of Rs 5 lakh at normal price

This plan offers -

Safety - to cover in an accidentEase - Easy registration and fast processing without any medical tests

Strength - by a nominal premium for all ages

Schedule your family's future today.

2. PRADHAN MANTRI SURKSHA BIMA YOJANA.

Maturity / Implicit Benefit:

There is no maturity or surrender benefit under this plan.Registration:

Pradhan Mantri Suraksha Bima Yojana (PMSBY)

Government through the Budget Speech 2015 announced three ambitious

Social Security Schemes pertaining to the Insurance and Pension Sectors, namely

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha

Bima Yojana (PMSBY) and an the Atal Pension Yojana (APY) to move towards

creating a universal social security system, targeted especially for the poor and

the under-privileged. Hon’ble Prime Minister will be launched these schemes

nationally in Kolkata on 9th May, 2015.

In light of the fact that a large proportion of the population have no accidental

insurance cover, the Pradhan Mantri Suraksha Bima Yojana (PMJJBY) is aimed at

covering the uncovered population at an highly affordable premium of just Rs.12

per year. The Scheme will be available to people in the age group 18 to 70 years

with a savings bank account who give their consent to join and enable auto-debit

on or before 31st May for the coverage period 1st June to 31st May on an annual

renewal basis.

Under the said scheme, risk coverage available will be Rs. 2 lakh for accidental

death and permanent total disability and Rs. 1 lakh for permanent partial

disability, for a one year period stretching from 1st June to 31st May. It is offered by

Public Sector General Insurance Companies or any other General Insurance

Company who are willing to offer the product on similar terms with necessary

approvals and tie up with banks for this purpose. Participating Bank will be the

Master policy holder on behalf of the participating subscribers. It will be the

responsibility of the participating bank to recover the appropriate annual

premium in one instalment, as per the option, from the account holders on or

before the due date through ‘auto-debit’ process and transfer the amount due to

the insurance company.

Individuals who exit the scheme at any point may re-join the scheme in future

years by paying the annual premium, subject to conditions. Further, in order to

assure a hassle free claim settlement experience for the claimants a simple and

subscriber friendly administration & claim settlement process has been put in

place.

To ensure that the benefits of this scheme is brought to every uninsured

individual, who holds a bank account, wide publicity was given for this social

security measure through electronic media, radio, posters, newspapers

advertisements etc. Enrollment forms were widely distributed. Highly publicised

Enrollment camps were conducted by Banks, and Insurance Companies,

mobilising the entire net work of SLBC Co ordinators, state and district level nodal

officers, agents and banking correspondents, thereby fully utilising the reach of

these channels, for attracting large scale enrolment in the scheme.

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY)

Government through the Budget Speech announced three ambitious Social

Security Schemes pertaining to the Insurance and Pension Sectors, namely Pradhan

MantriJeevanJyotiBimaYojana (PMJJBY), Pradhan Mantri Suraksha BimaYojana

(PMSBY)and an the Atal Pension Yojana (APY) to move towards creating a universal

social security system, targeted especially for the poor and the under-privileged. Hon’ble

Prime Minister launched PMJJBY and PMSBY schemes nationally in Kolkata on 9th May,

2015.

2. The Pradhan MantriJeevanJyotiBimaYojana (PMJJBY) is a one year life insurance

scheme, renewable from year to year, offering coverage for death due to any reason and

is available to people in the age group of 18 to 50 years( life cover upto age 55) having a

savings bank account who give their consent to join and enable auto-debit. The risk

cover on the lives of the enrolled persons has commenced from 1st June 2015.

3. Under PMJJBY scheme, life cover of Rs. 2 lakhs is available for a one year period

stretching from 1st June to 31st May at a premium of Rs.330/- per annum per member and

is renewable every year. It is offered / administered through LIC and other Indian private

Life Insurance companies. For enrolment banks have tied up with insurance companies.

Participating Bank is the Master policy holder.

4. The assurance on the life of the member shall terminate on any of the following

events and no benefit will become payable there under:

1) On attaining age 55 years (age near birth day) subject to annual renewal up to

that date (entry, however, will not be possible beyond the age of 50 years).

2) Closure of account with the Bank or insufficiency of balance to keep the insurance

in force.

3) A person can join PMJJBY with one Insurance company with one bank account

only.

5. Individuals who exit the scheme at any point may re-join the scheme in future

years by paying the annual premium and submitting a self-declaration of good health

Brief on Atal Pension Yojana

Atal Pension Yojana (APY) is open to all bank account holders. The Central Government

would also co-contribute 50% of the total contribution or Rs. 1000 per annum, whichever

is lower, to each eligible subscriber, for a period of 5 years, i.e., from Financial Year 2015-

16 to 2019-20, who join the APY before 31st December, 2015, and who are not members of

any statutory social security scheme and who are not income tax payers. Therefore, APY

will be focussed on all citizens in the unorganised sector.

2. Under APY, the monthly pension would be available to the subscriber, and after

him to his spouse and after their death, the pension corpus, as accumulated at age 60 of

the subscriber, would be returned to the nominee of the subscriber.

3. Under the APY, the subscribers would receive the fixed minimum pension of Rs.

1000 per month, Rs. 2000 per month, Rs. 3000 per month, Rs. 4000 per month, Rs. 5000

per month, at the age of 60 years, depending on their contributions, which itself would

be based on the age of joining the APY. Therefore, the benefit of minimum pension would

be guaranteed by the Government. However, if higher investment returns are received on

the contributions of subscribers of APY, higher pension would be paid to the subscribers.

4. A subscriber joining the scheme of Rs. 1,000 monthly pension at the age of 18

years would be required to contribute Rs. 42 per month. However, if he joins at age 40,

he has to contribute Rs. 291 per month. Similarly, a subscriber joining the scheme of Rs.

5,000 monthly pension at the age of 18 years would be required to contribute Rs. 210 per

month. However, if he joins at age 40, he has to contribute Rs. 1,454 per month.

Therefore, it is better to join early in the Scheme. The contribution levels, the age of entry

and the pension amounts are available in a table given in frequently asked questions

(FAQs) on APY, which is available on www.jansuraksha.gov.in.

5. The minimum age of joining APY is 18 years and maximum age is 40 years.

Therefore, minimum period of contribution by any subscriber under APY would be 20

years or more.

The commencement date of insurance cover is the date on which the premium is debited from the insured's account to join the scheme and the insurance cover will be till May 31 of the following year. Thereafter, the insurance cover can be renewed on June 1 of each year by borrowing the premium in your Savings Bank account. These premiums are subject to change as specified from time to time by the Government of India.

If the member wishes to join the scheme after June 1, he / she can join

by paying pro-rate premium on the basis of the month in which he / she

is involved for the whole year and submitting the required documents /

declarations, if any, as specified in the rules of the scheme. . The

rules for admission shall be as prescribed by the Government of India

from time to time. The whole year's premium i.e. Rs.50 / - will be

payable at the time of renewal under the scheme and pro-rate payment

cannot be made.

3. ATAL PANSION YOJANA.

- Income security during old age.

- The purpose of this scheme is to invest in voluntary retirement.

- Will be focused on workers in the unorganized sector.

- Implementation will take place from 01-09-2018.

- Eligibility: Minimum age will be 18 years and maximum age limit will be 60 years.

- The administration will be done by the Pension Fund Regulatory and Development Authority (PFRDA).

The Atal Pension Scheme is like a safety net for aging Indians. At the same time the scheme promotes a culture of saving among the lower and lower middle class people of the society. The biggest feature of this scheme is that it benefits the poor citizens of the country. In this too, the Government of India is giving the facility to those who are involved in this scheme till 31st December 2018 to pay 50 per cent of the amount to be paid for 3 years or Rs. 1000 whichever is less.

OFFICIAL SITE AND REGISTRATION AND MORE DETAILS VISIT:- CLICK HERE

DOWNLOAD FORM :- CLICK HERE

Eligibility of the beneficiary of Atal Pension Scheme

The Atal Pension Scheme (APY) is for all Indian citizens between the ages of 18 and 40. To avail the benefits of this scheme, everyone has to pay the amount fixed by the government for at least 30 years. Any bank account holder who is not a member of any such social security scheme can avail this scheme.Pradhan Mantri Suraksha Bima Yojana is

out there to people (Indian Resident or NRI) between 18 and 70 years

aged with bank accounts. it's an annual premium of RS. 12 exclusive of

taxes. GST is exempted on Pradhan Mantri Suraksha Bima SCHEME . the

quantity is automatically debited from the account. This insurance

scheme can have one year cover from 1 June to 31 May and would be

offered through banks and administered through public sector general

insurance companies.

Important:-For better result always use google cromeNote:-Please Always Check and Conform Above Details with The Official Website and Advertisement / Notification.

0 Comments:

Post a Comment