1. Overview

The pre-filling and filing of ITR-1 service is available to registered users on the e-Filing portal. This service enables individual taxpayers to file ITR-1 online through the e-Filing portal. This user manual covers filing of ITR-1 through online mode.

2. Prerequisites for availing this service

General |

|

Others |

|

3. Form at a Glance

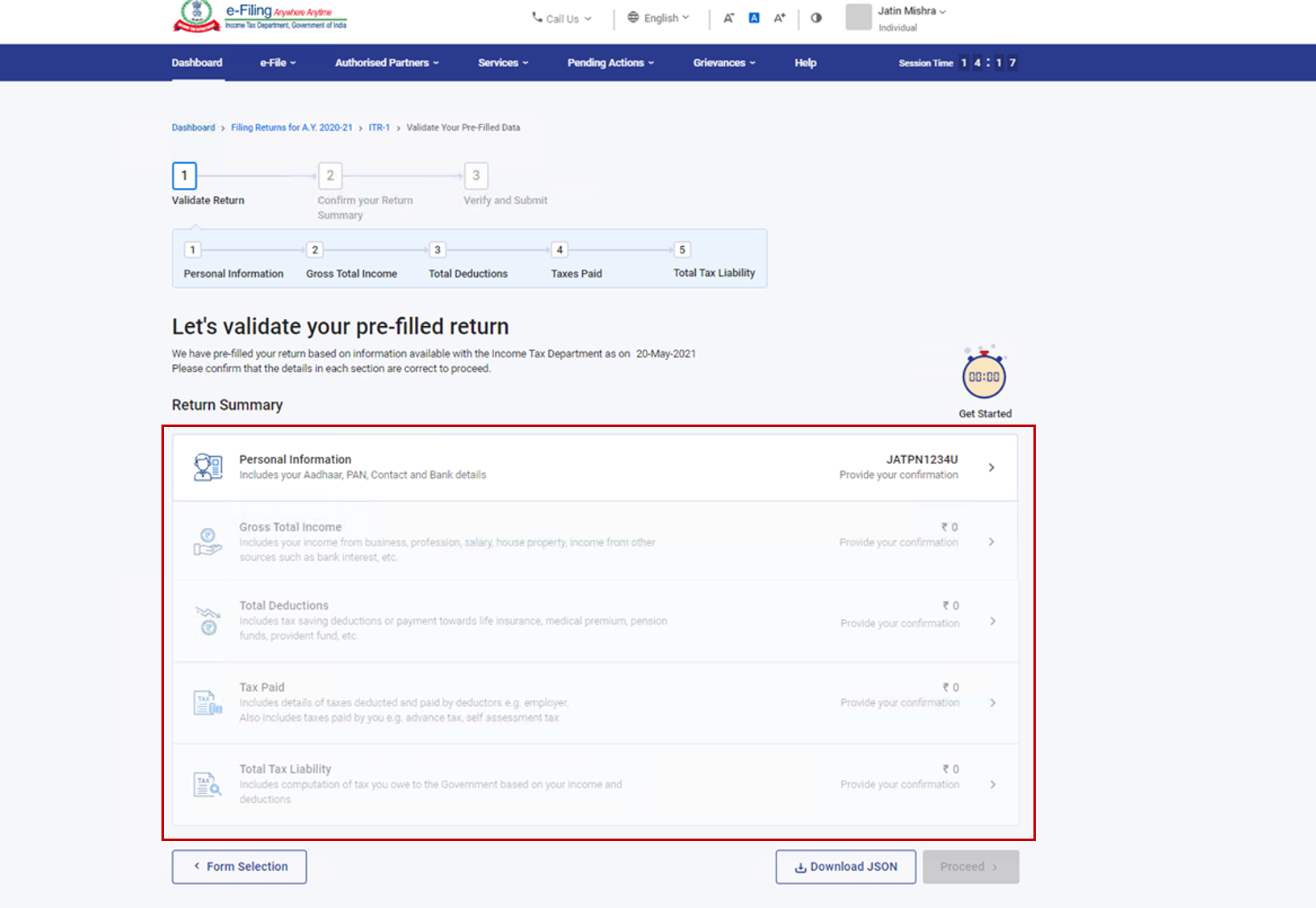

ITR-1 has five sections that you need to fill before submitting it and one summary section where you are required to review your tax computation. The sections are as follows:

- Personal Information

- Gross Total Income

- Total Deductions

- Tax Paid

- Total Tax Liability

Here is a quick tour of the various sections of ITR-1:

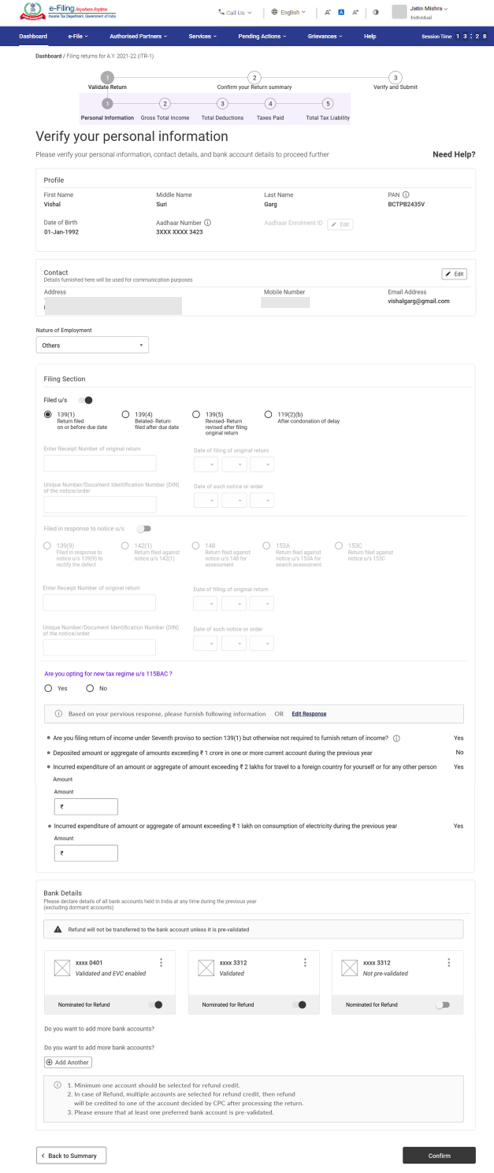

3.1 Personal Information

In the Personal Information section of the ITR, you need to verify the pre-filled data which is auto-filled from your e-Filing profile. You will not be able to edit some of your personal data directly in the form. However, you can make the necessary changes by going to your e-Filing profile. You can edit your contact details, filing type details and bank details in the form.

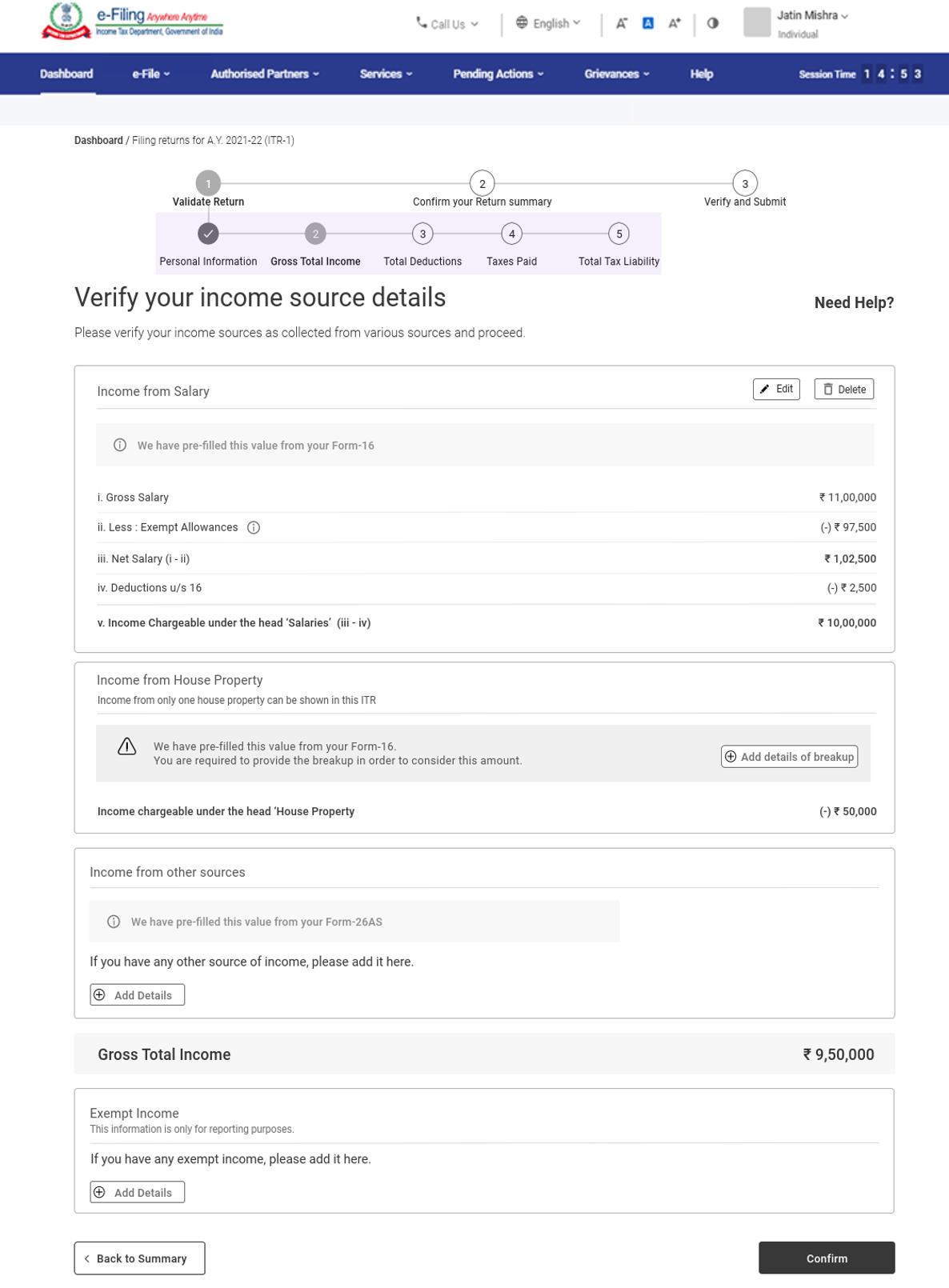

3.2 Gross Total Income

In the Gross Total Income section, you need to review the pre-filled information and verify your income source details from salary / pension, house property, and other sources (such as interest income, family pension, etc.).You will also be required to enter the remaining / additional details including your exempt income, if any.

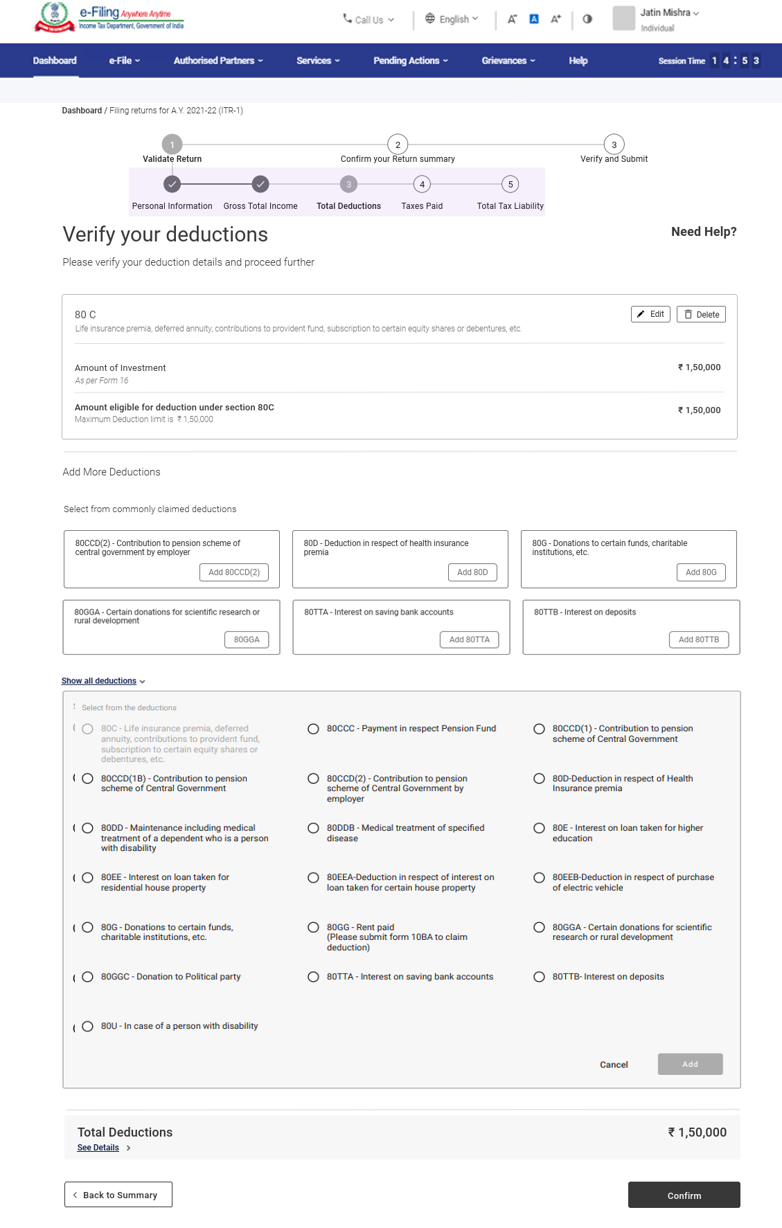

3.3 Total Deductions

In the Total Deductions section, you need to add and verify any deductions you wish to claim under Chapter VI-A of the Income Tax Act.

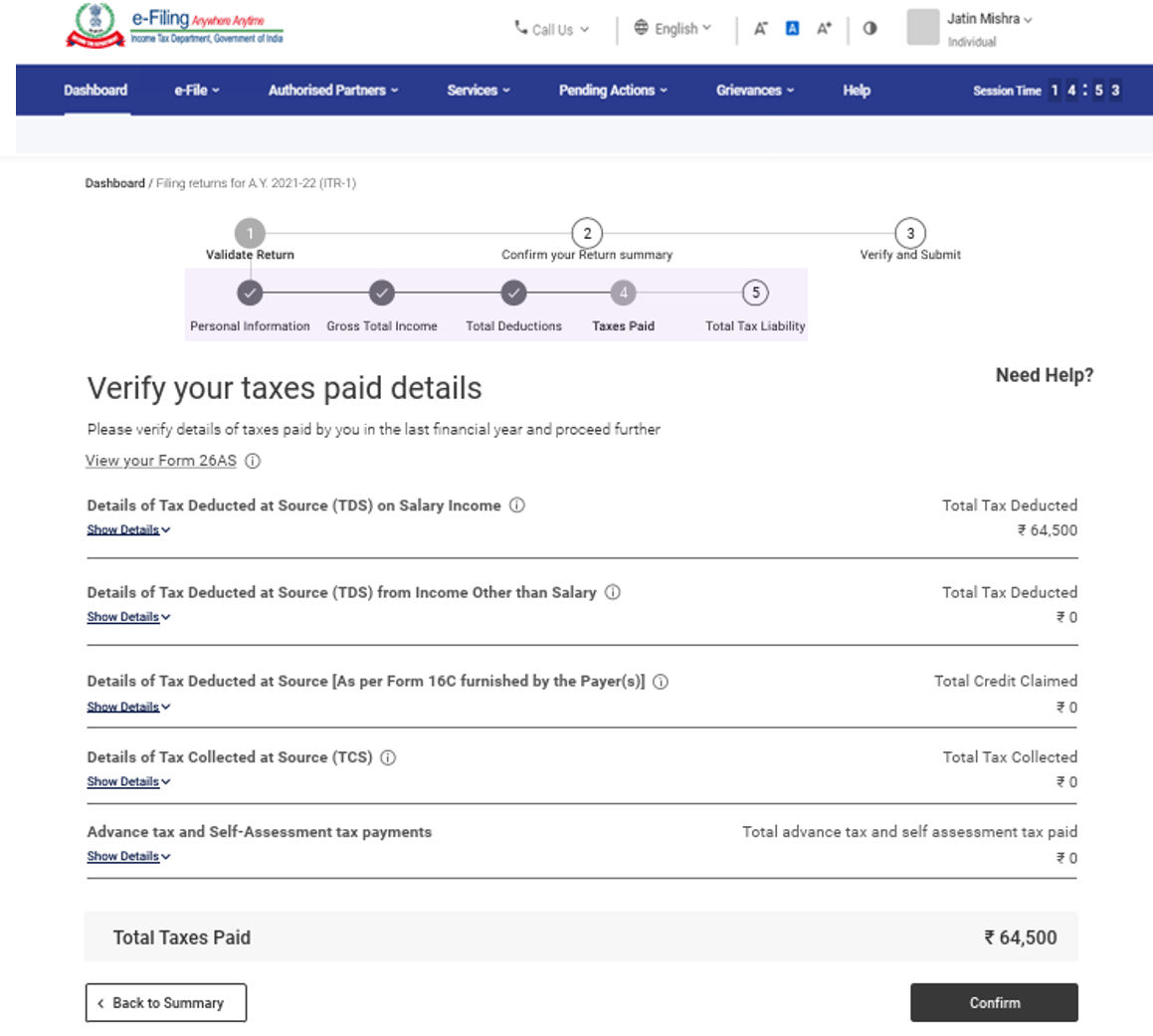

3.4 Tax Paid

In the Tax Paid section, you need to verify taxes paid by you in the previous year. Tax details include TDS from Salary / Other than Salary as furnished by Payer, TCS, Advance Tax and Self-Assessment Tax.

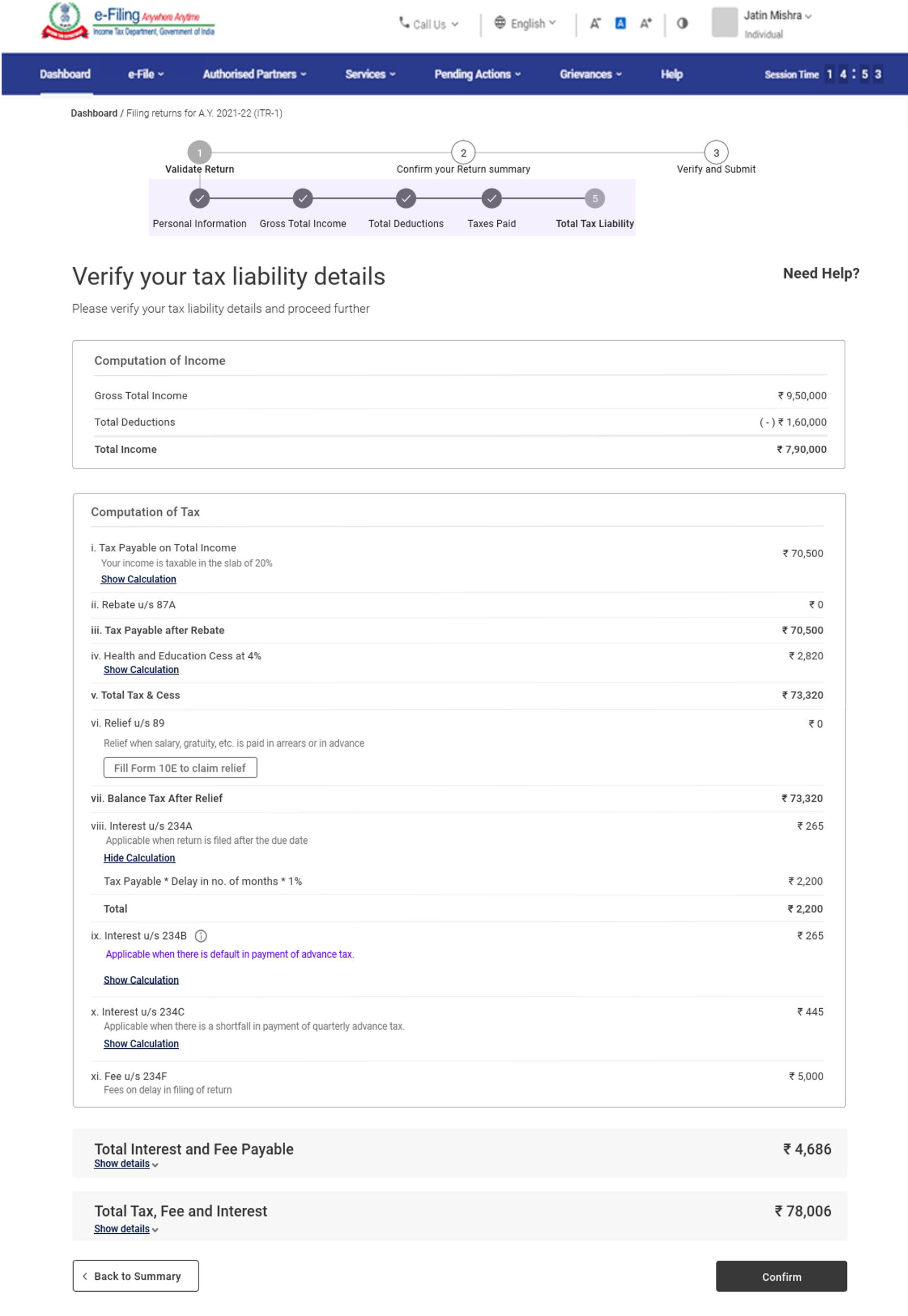

3.5 Total Tax Liability

In the Total Tax Liability section, you need to review tax liability computed as per the sections filled previously.

Note: For more details, refer to the instructions to file ITR issued by CBDT for AY 2021-22.

4. How to Access and Submit ITR - 1

You can file and submit your ITR through the following methods:

- Online Mode – through e-Filing portal

- Offline Mode – through Offline Utility

You can refer to the Offline Utility (for ITRs) user manual to learn more.

Follow the steps below to file and submit the ITR through online mode:

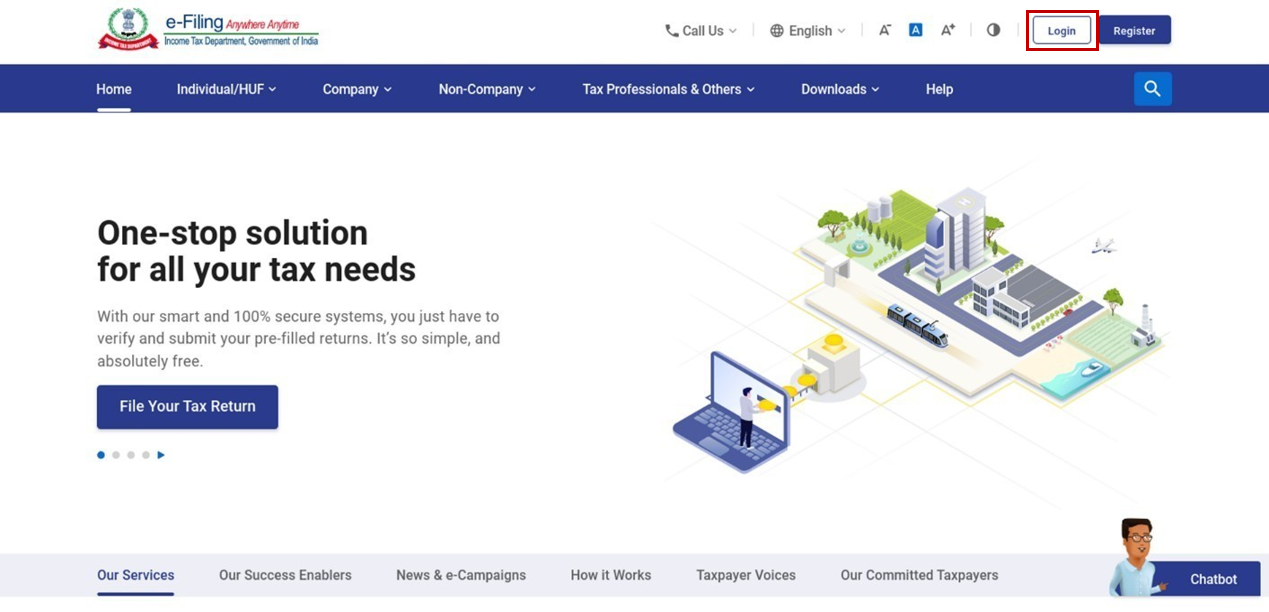

Step 1: Log in to the e-Filing portal using your user ID and password.

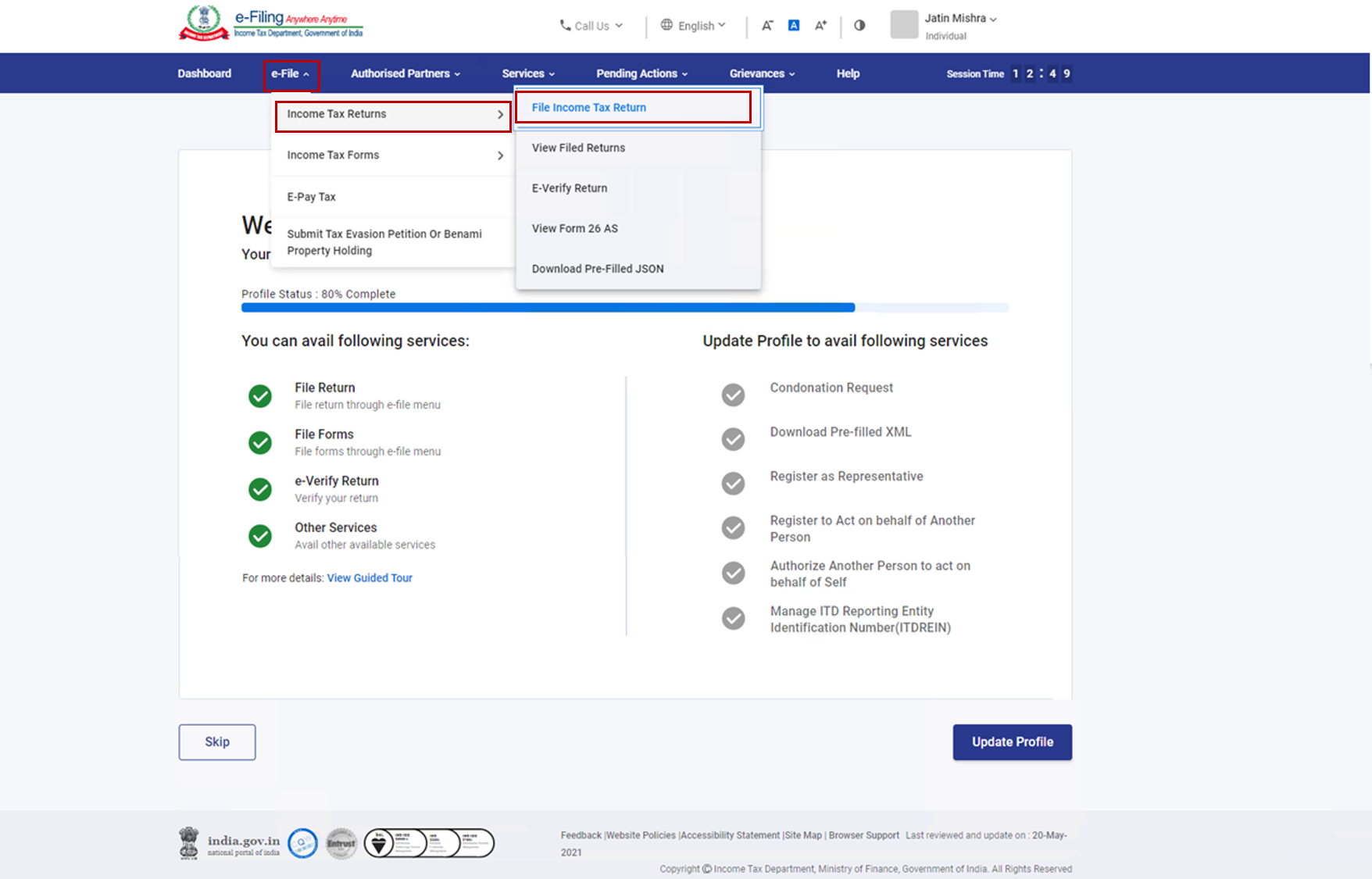

Step 2: On your Dashboard, click e-File > Income Tax Returns > File Income Tax Return.

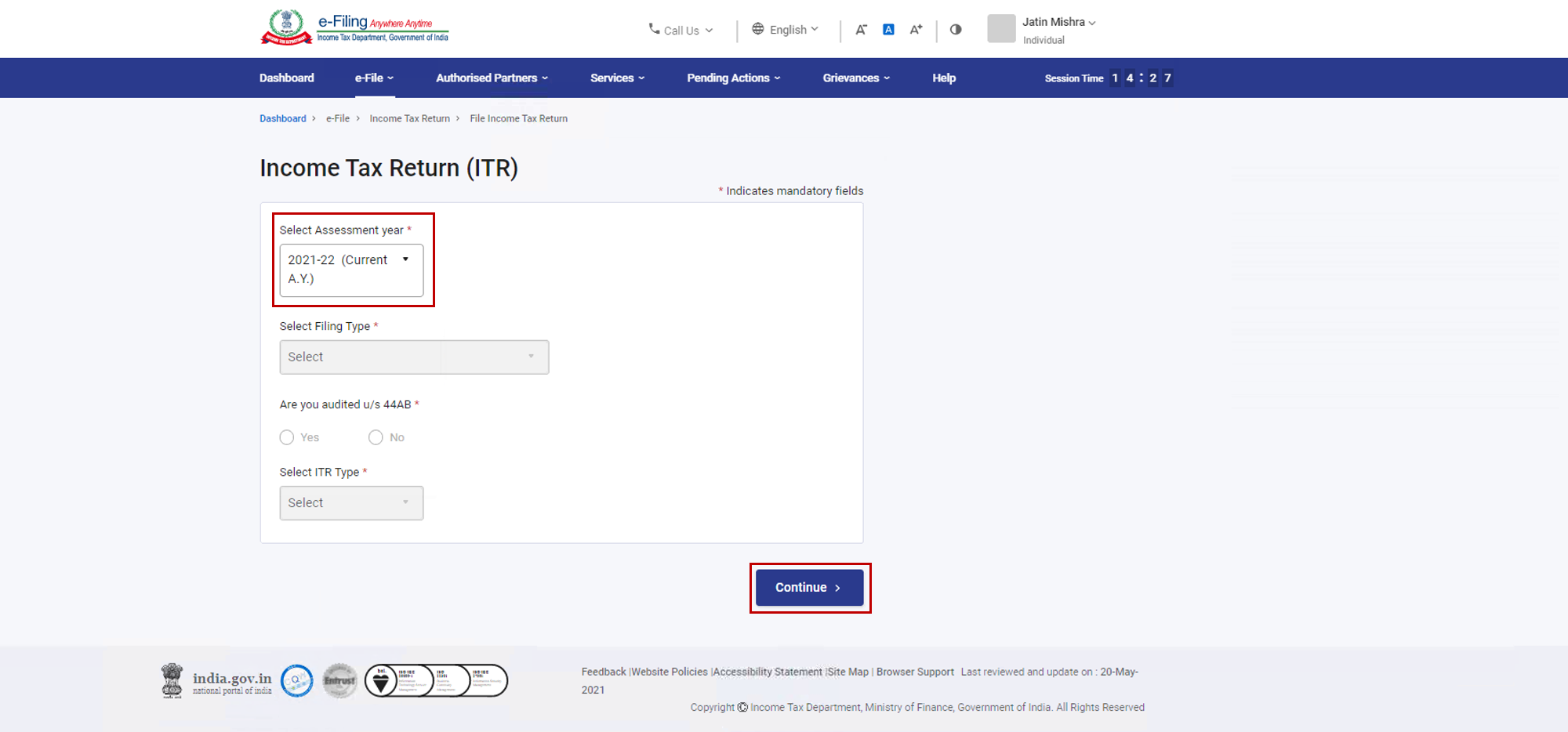

Step 3: Select Assessment Year as 2021 – 22 and click Continue.

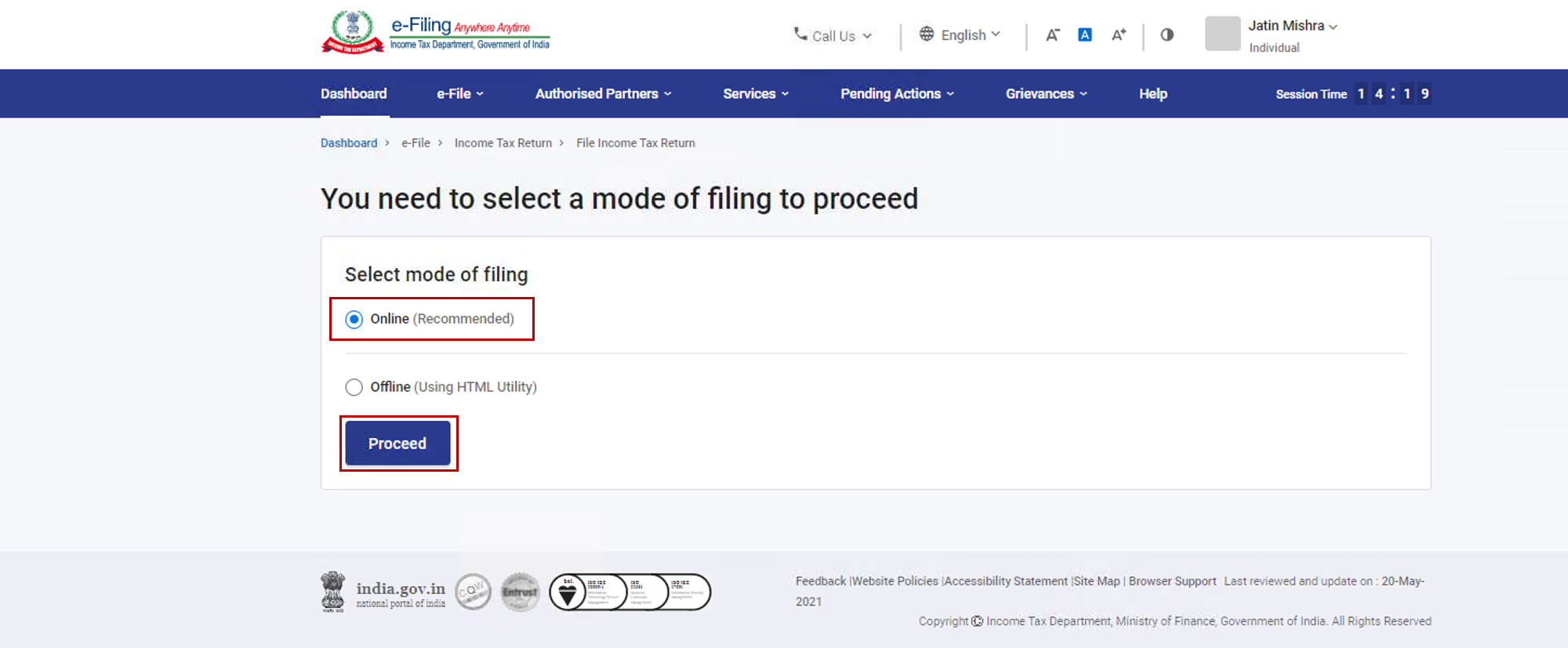

Step 4: Select Mode of Filing as Online and click Proceed.

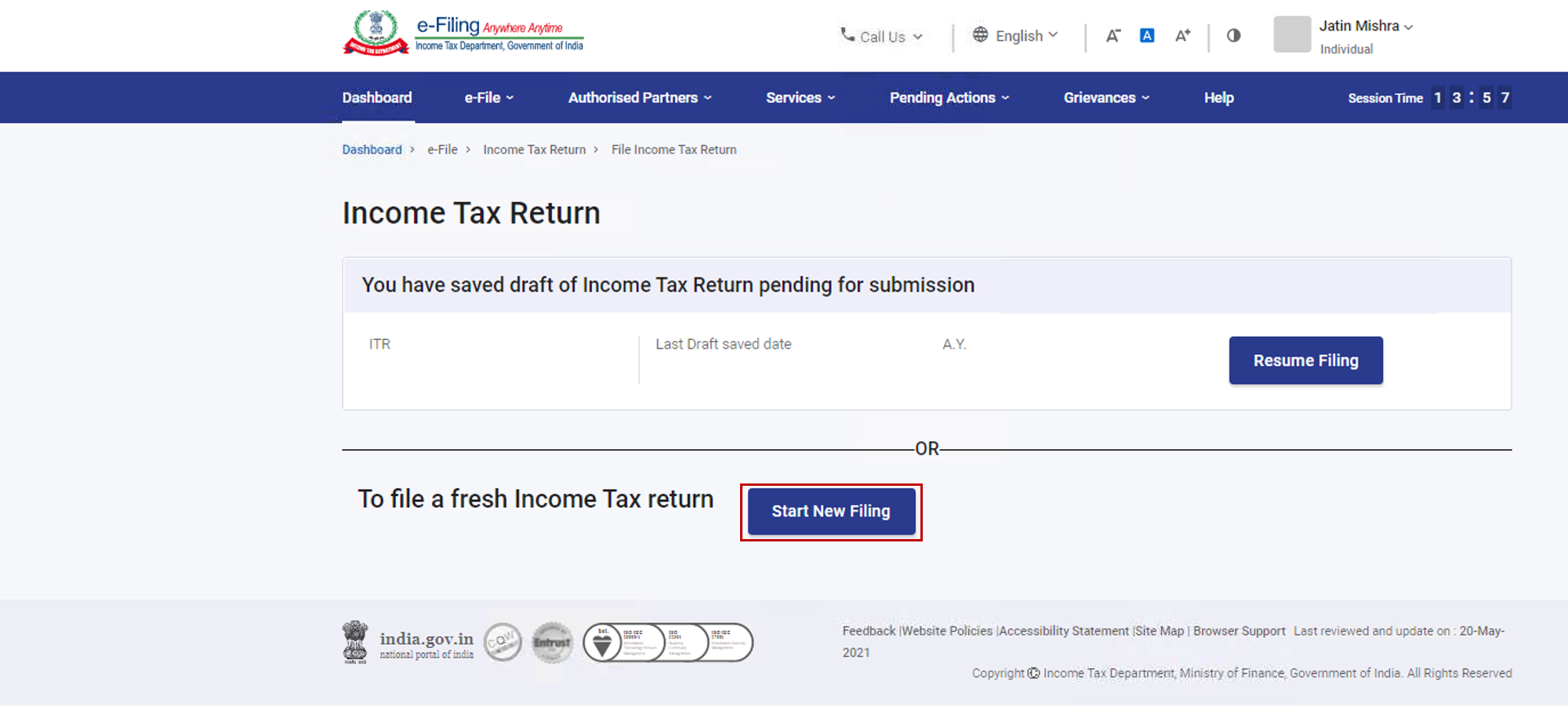

Note: In case you have already filled the Income Tax Return and it is pending for submission, click Resume Filing. In case you wish to discard the saved return and start preparing the return afresh click Start New Filing.

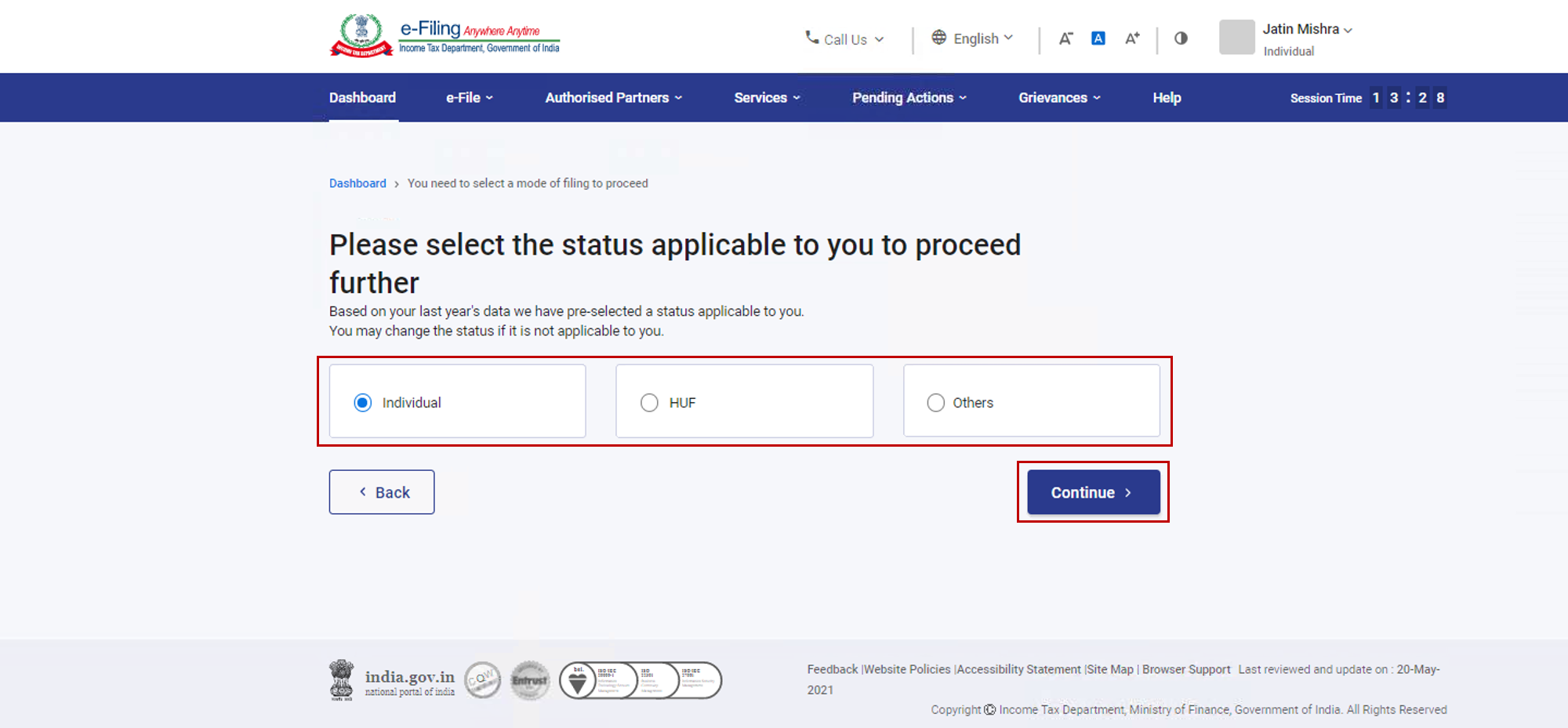

Step 5: Select Status as applicable to you and click Continue to proceed further.

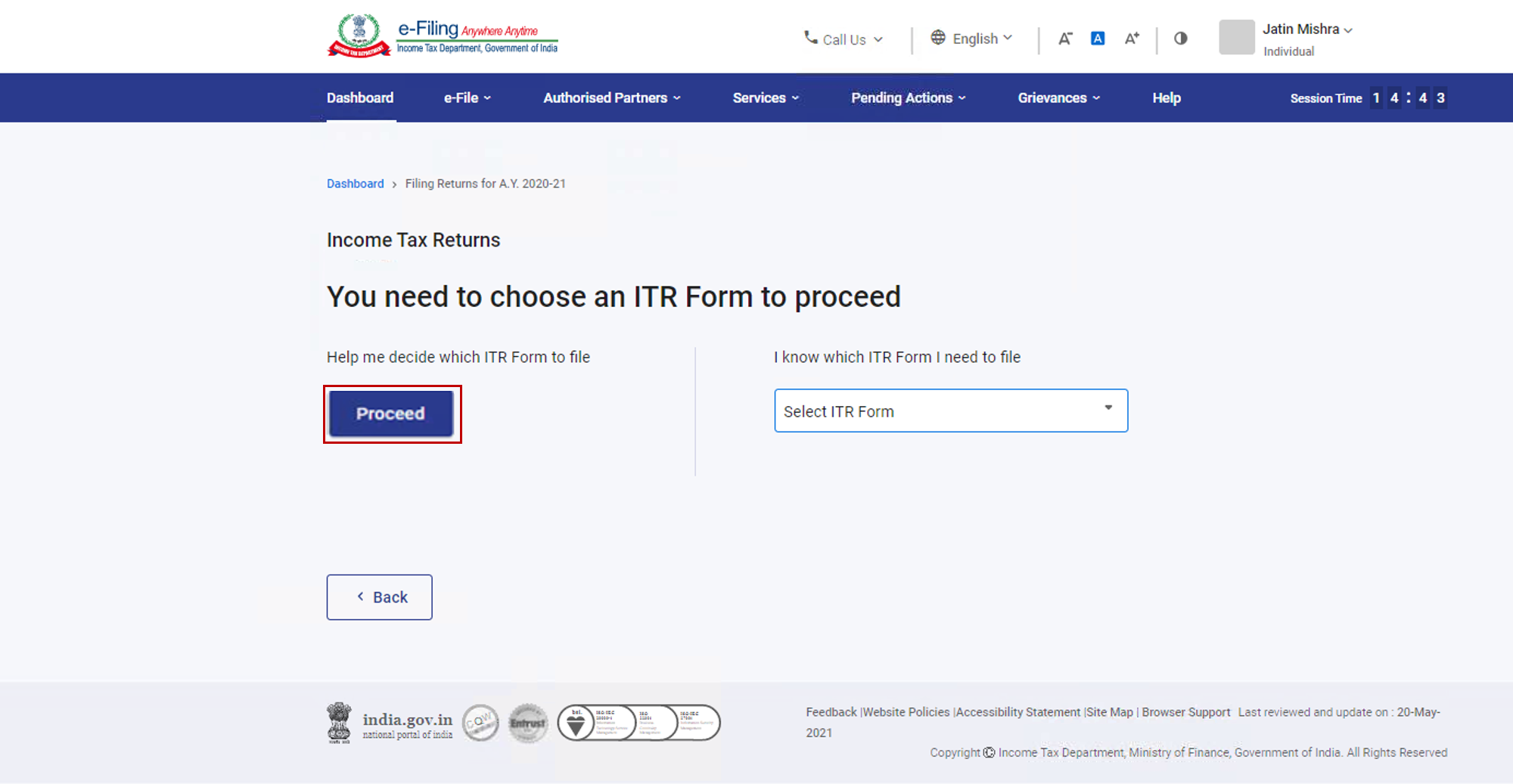

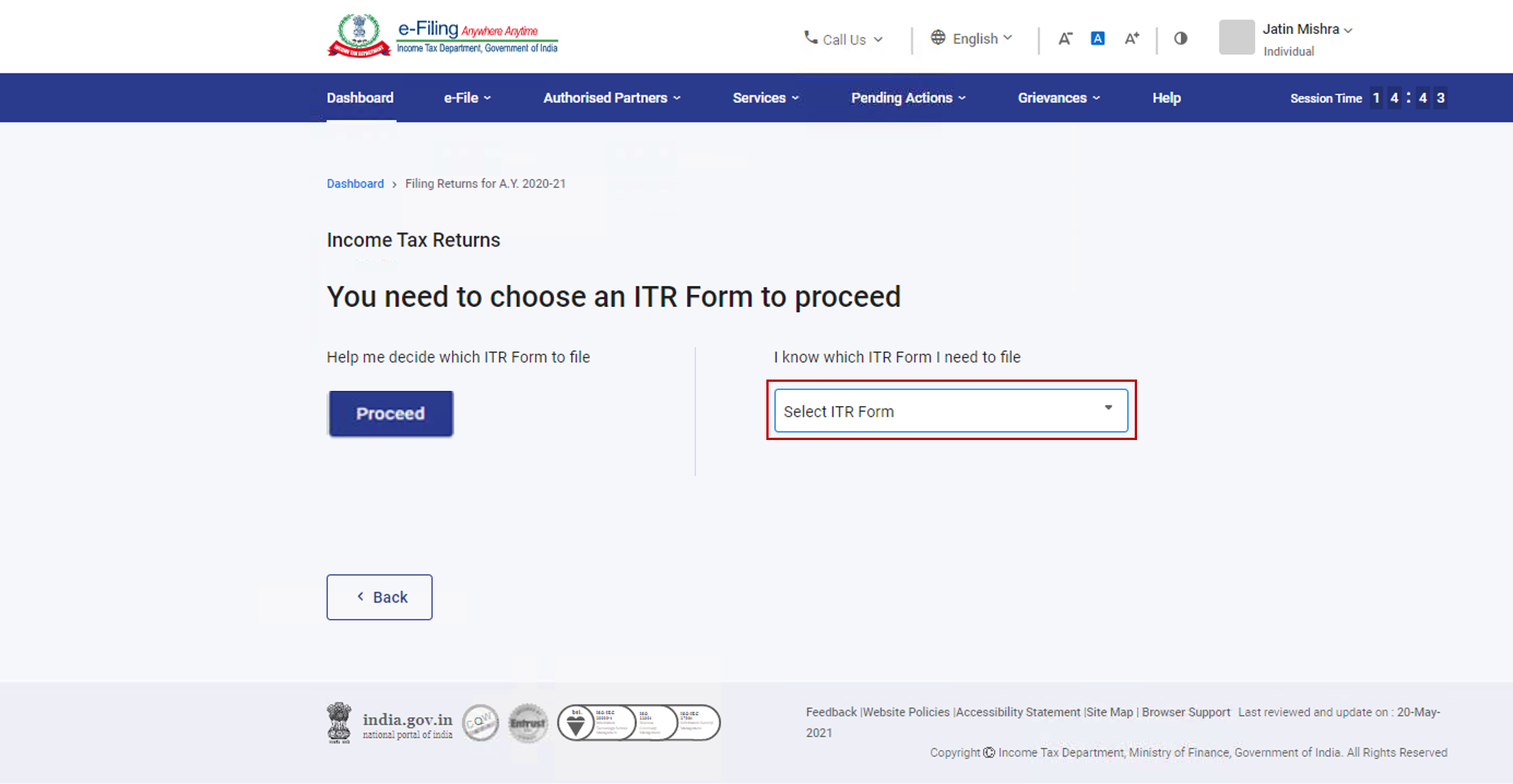

Step 6: You have two options to select the type of Income Tax Return:

- If you are not sure which ITR to file, you may select Help me decide which ITR Form to file and click Proceed. Once the system helps you determine the correct ITR, you can proceed with filing your ITR.

- If you are sure which ITR to file, select I know which ITR Form I need to file. Select the applicable Income Tax Return from the dropdown and click Proceed with ITR.

Note:

- In case you are not aware which ITR or schedules are applicable to you or income and deductions details, your answers in response to a set of questions will guide in determining the same and help you in correct / error free filing of ITR.

- In case you are aware of the ITR or schedules applicable to you or income and deduction details, you can skip these questions.

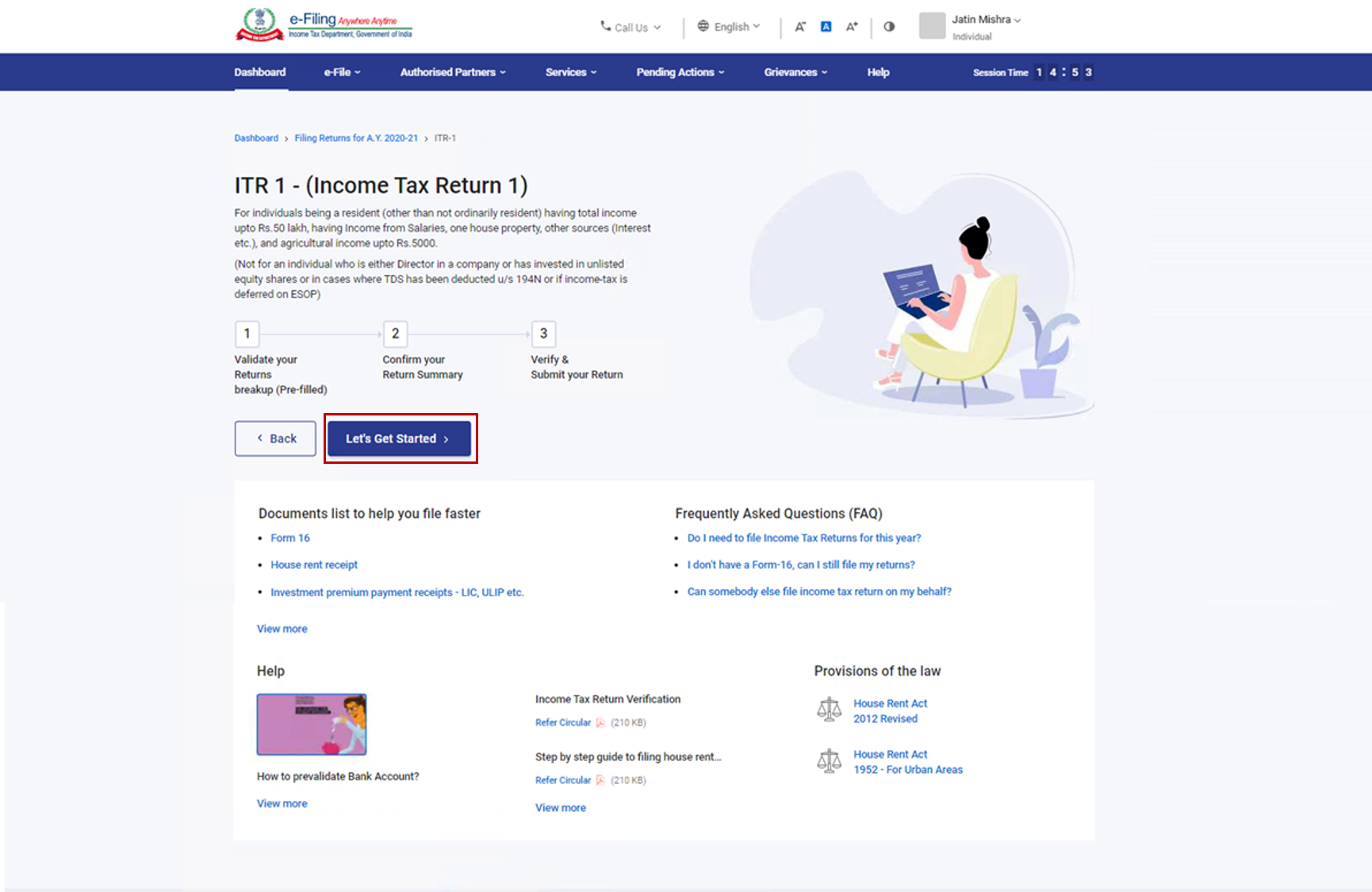

Step 7: Once you have selected the ITR applicable to you, note the list of documents needed and click Let’s Get Started.

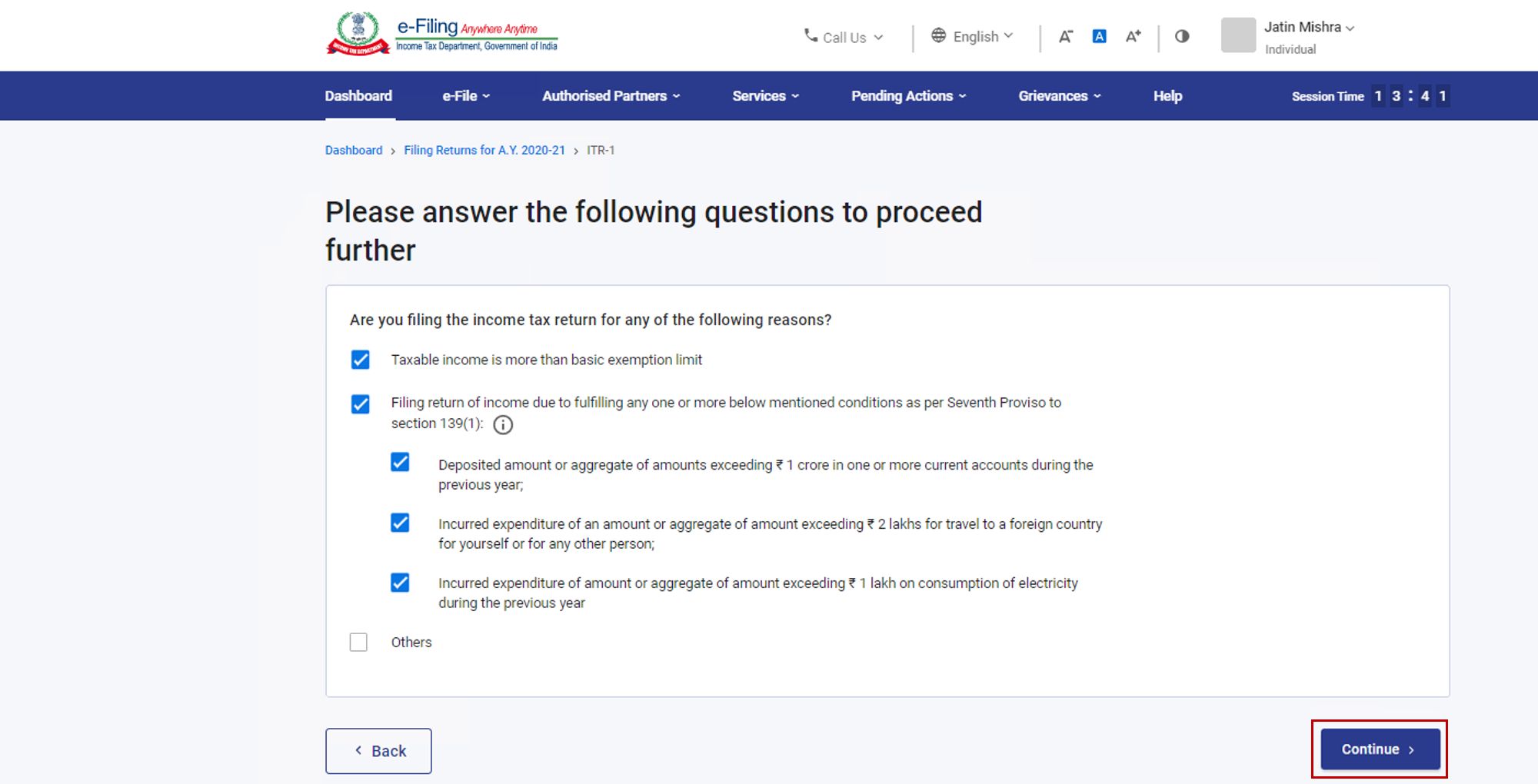

Step 8: Select the checkboxes applicable to you and click Continue.

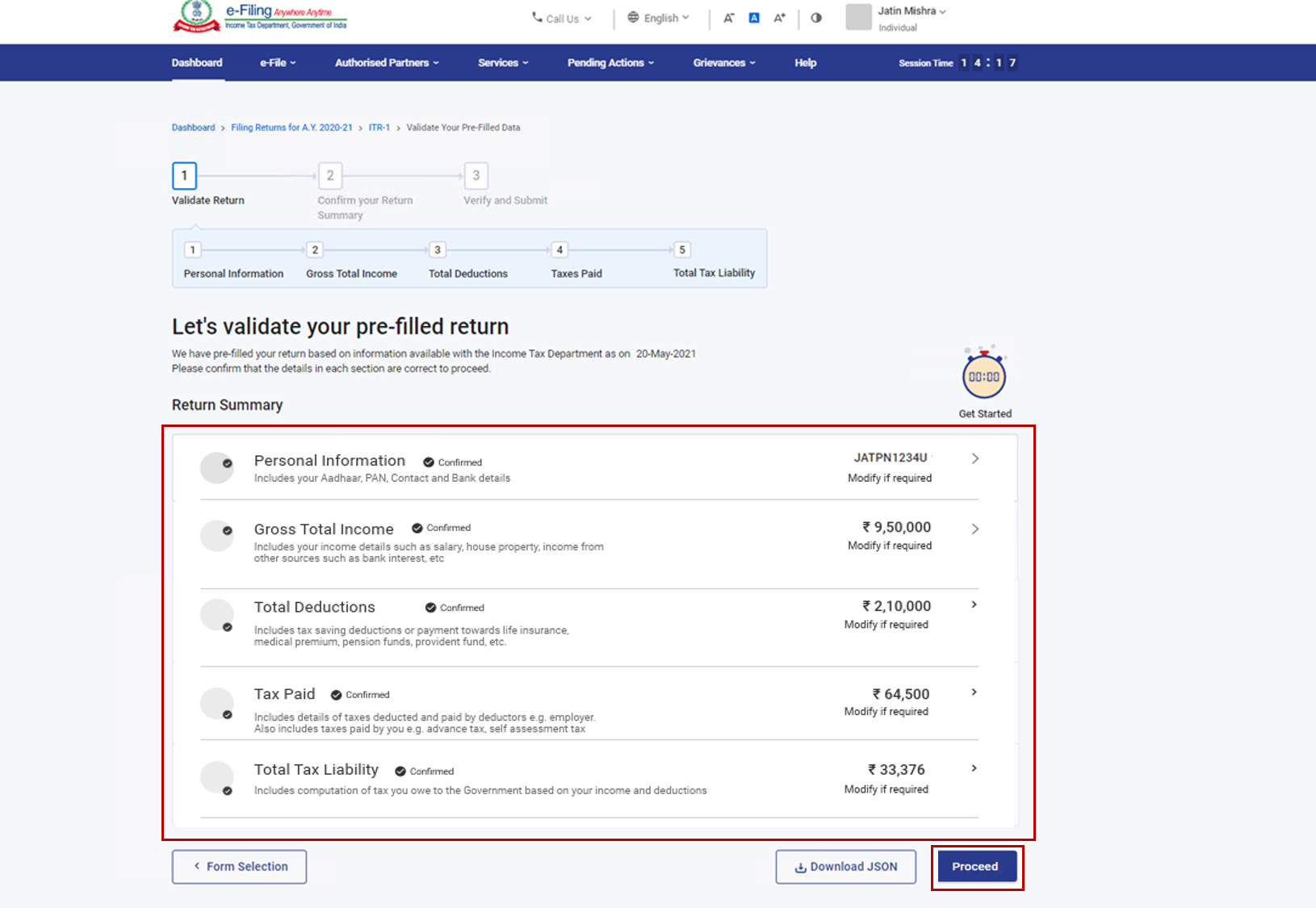

Step 9: Review your pre-filled data and edit it if necessary. Enter the remaining / additional data (if required). Click Confirm at the end of each section.

Step 10: Enter your income and deduction details in the different section. After completing and confirming all the sections of the form, click Proceed.

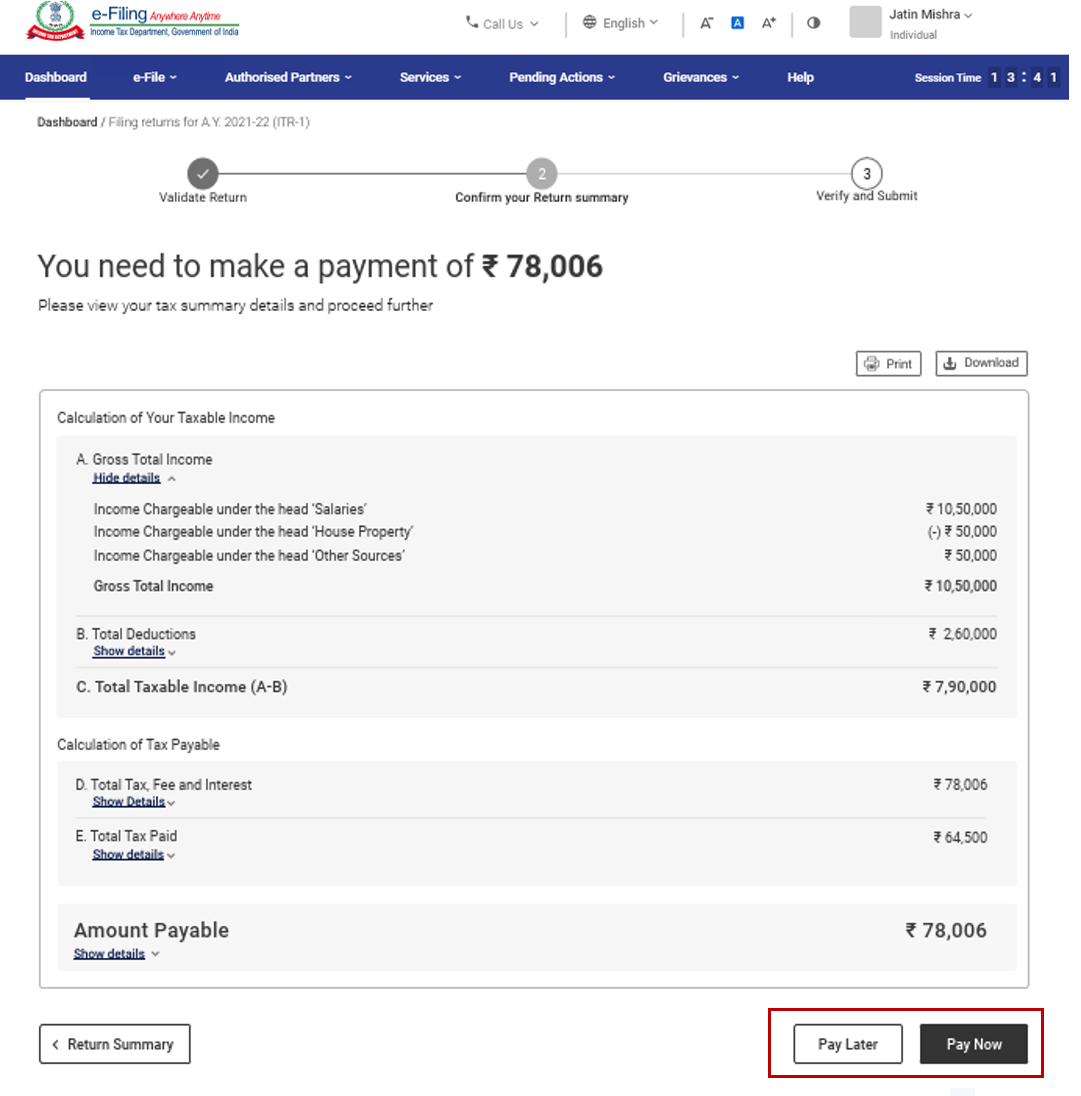

Step 10a: In case there is a tax liability

You will be shown a summary of your tax computation based on the details provided by you. If there is tax liability payable based on the computation, you get the Pay Now and Pay Later options at the bottom of the page.

Note:

- It is recommended to use the Pay Now option. Carefully note the BSR Code and Challan Serial Number and enter them in the details of payment.

- If you opt to Pay Later, you can make the payment after filing your Income Tax Return, but there is a risk of being considered as an assessee in default, and liability to pay interest on tax payable may arise.

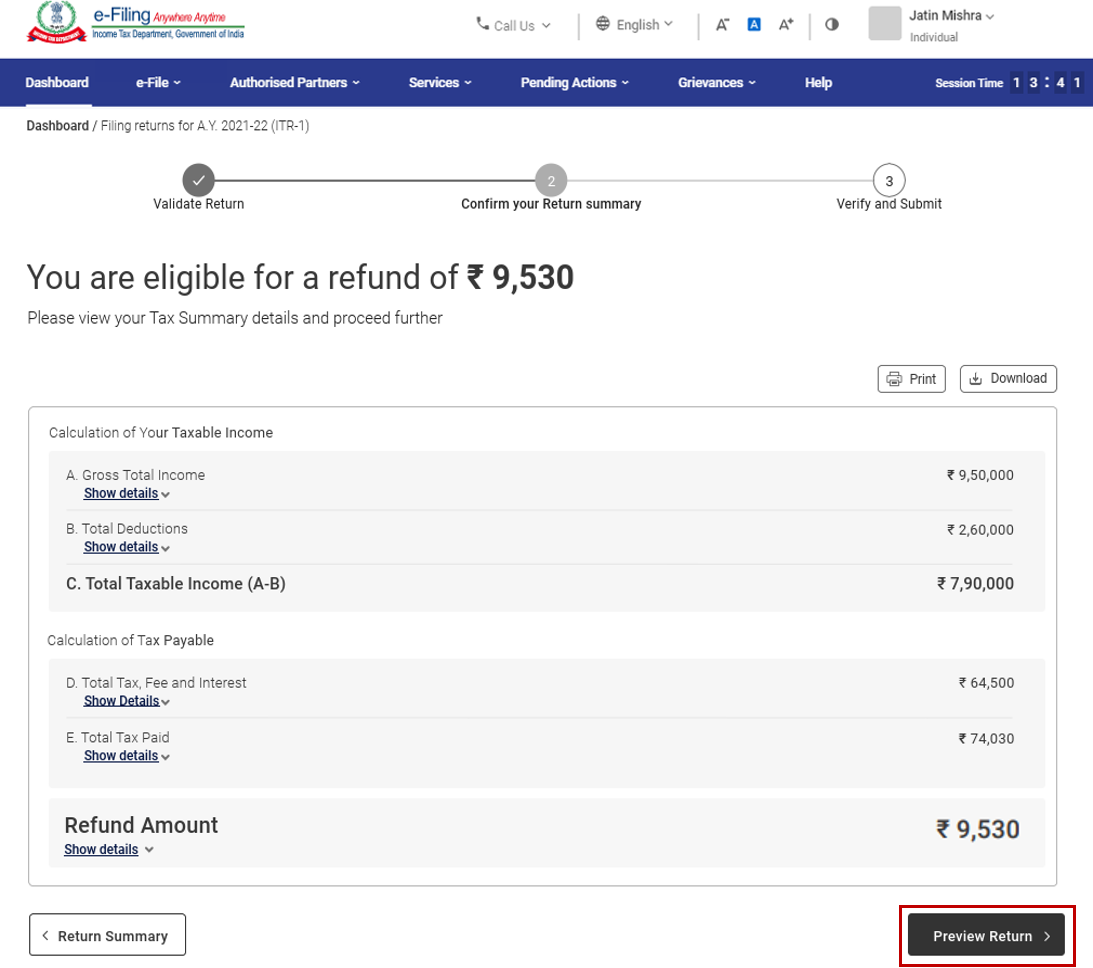

Step 10b: In case there is no tax liability (No Demand / No Refund) or if you are eligible for a Refund

After paying tax, click Preview Return. If there is no tax liability payable, or if there is a refund based on tax computation, you will be taken to the Preview and Submit Your Return page.

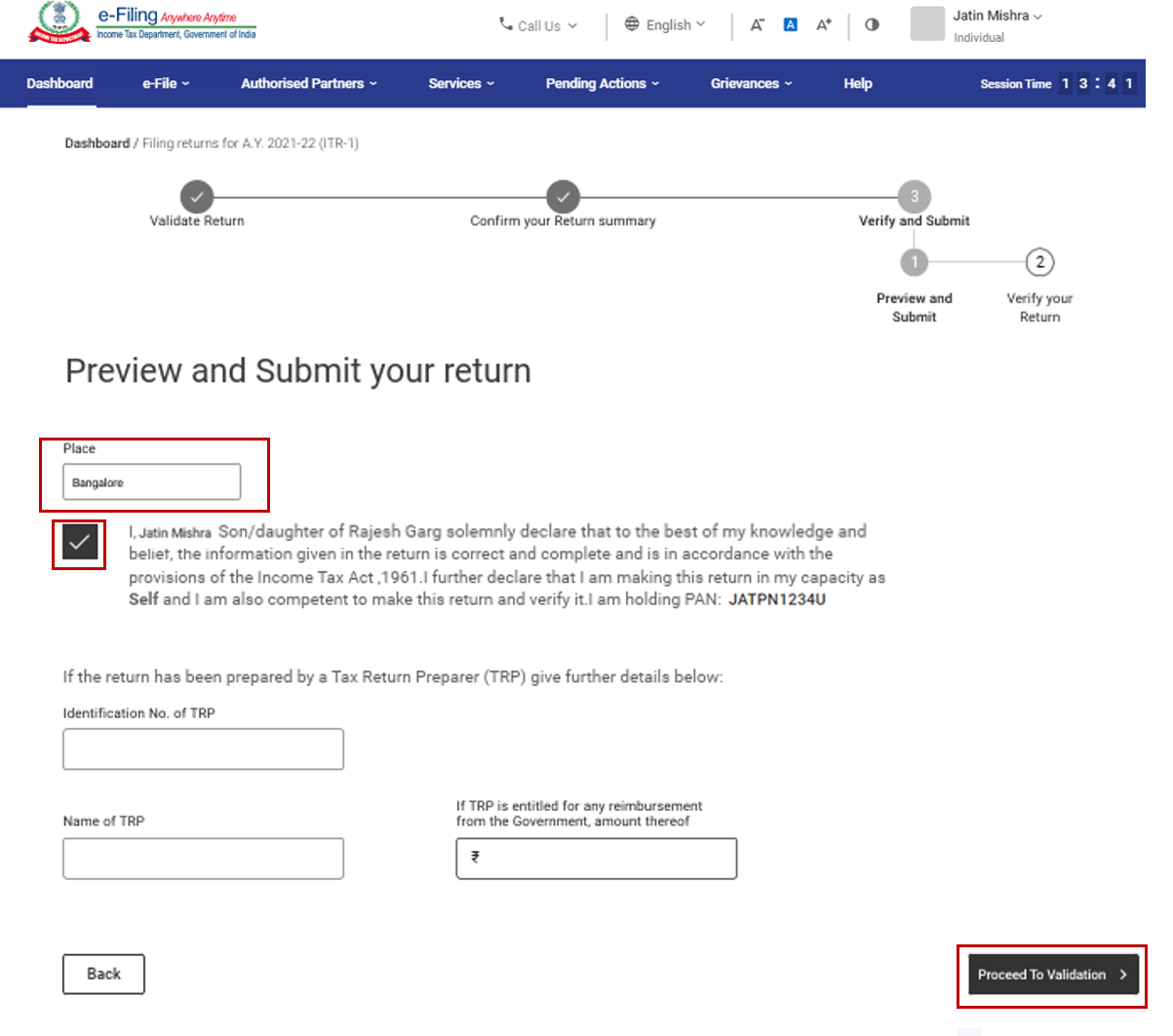

Step 11: On the Preview and Submit Your Return page, enter Place, select the declaration checkbox and click Proceed to Validation.

Note: If you have not involved a tax return preparer or TRP in preparing your return, you can leave the textboxes related to TRP blank.

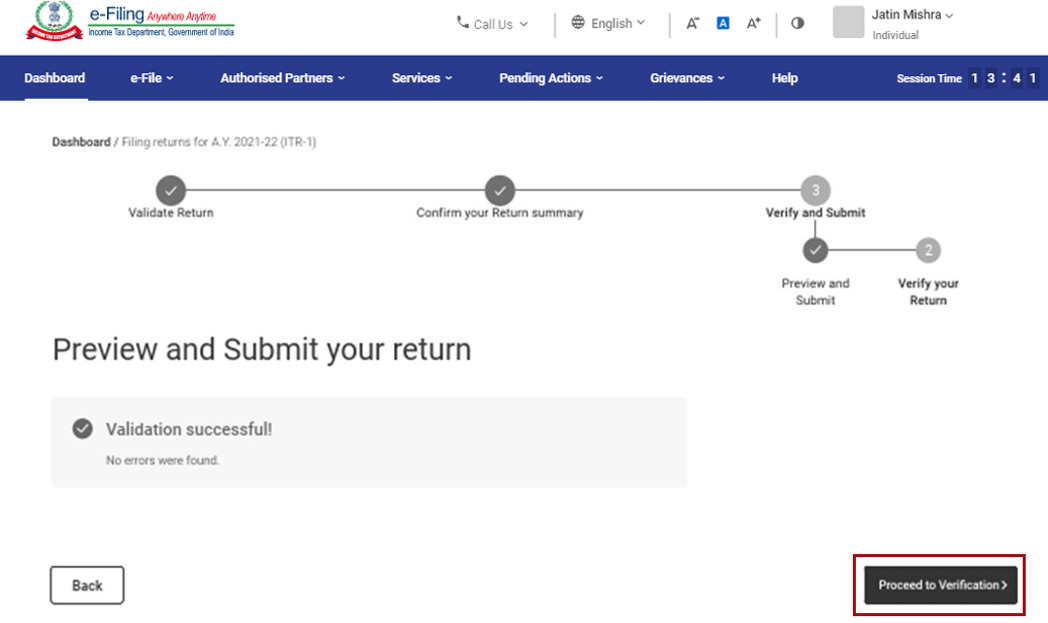

Step 12: Once validated, on your Preview and Submit your Return page, click Proceed to Verification.

Note: If you are shown a list of errors in your return, you need to go back to the form to correct the errors. If there are no errors, you can proceed to e-Verify your return by clicking Proceed to Verification.

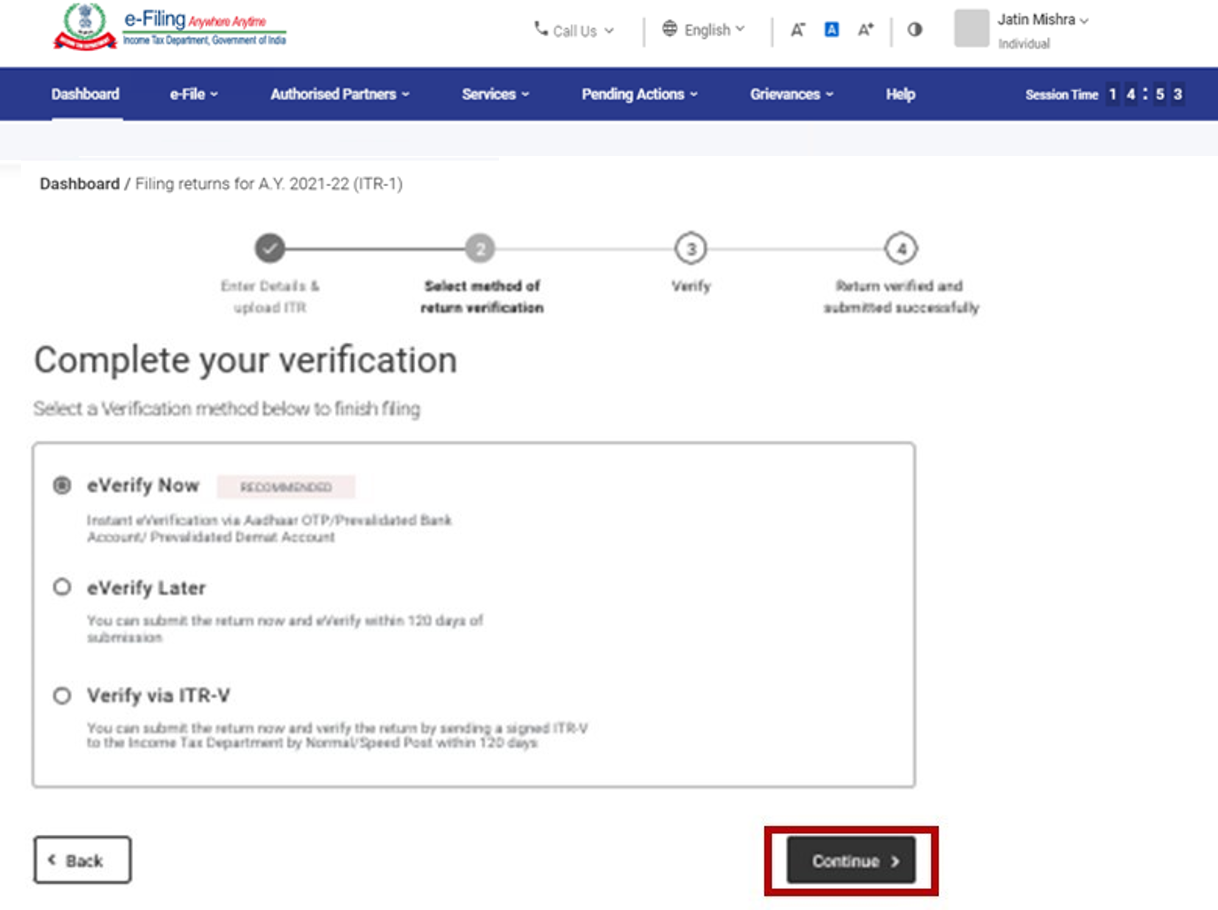

Step 13: On the Complete your Verification page, select your preferred option and click Continue.

It is mandatory to verify your return, and e-Verification (recommended option - e-Verify Now) is the easiest way to verify your ITR – it is quick, paperless, and safer than sending a signed physical ITR-V to CPC by post.

Note: In case you select e-Verify Later, you can submit your return, however, you will be required to verify your return within 120 days of filing of your ITR.

Step 14: On the e-Verify page, select the option through which you want to e-Verify the return and click Continue.

Note:

- Refer to the How to e-Verify user manual to learn more.

- If you select Verify via ITR-V, you need to send a signed physical copy of your ITR-V to Centralized Processing Center, Income Tax Department, Bengaluru 560500 by normal / speed post within 120 days.

- Please make sure you have pre-validated your bank account so that any refunds due maybe credited to your bank account.

- Refer to the My Bank Account user manual to learn more.

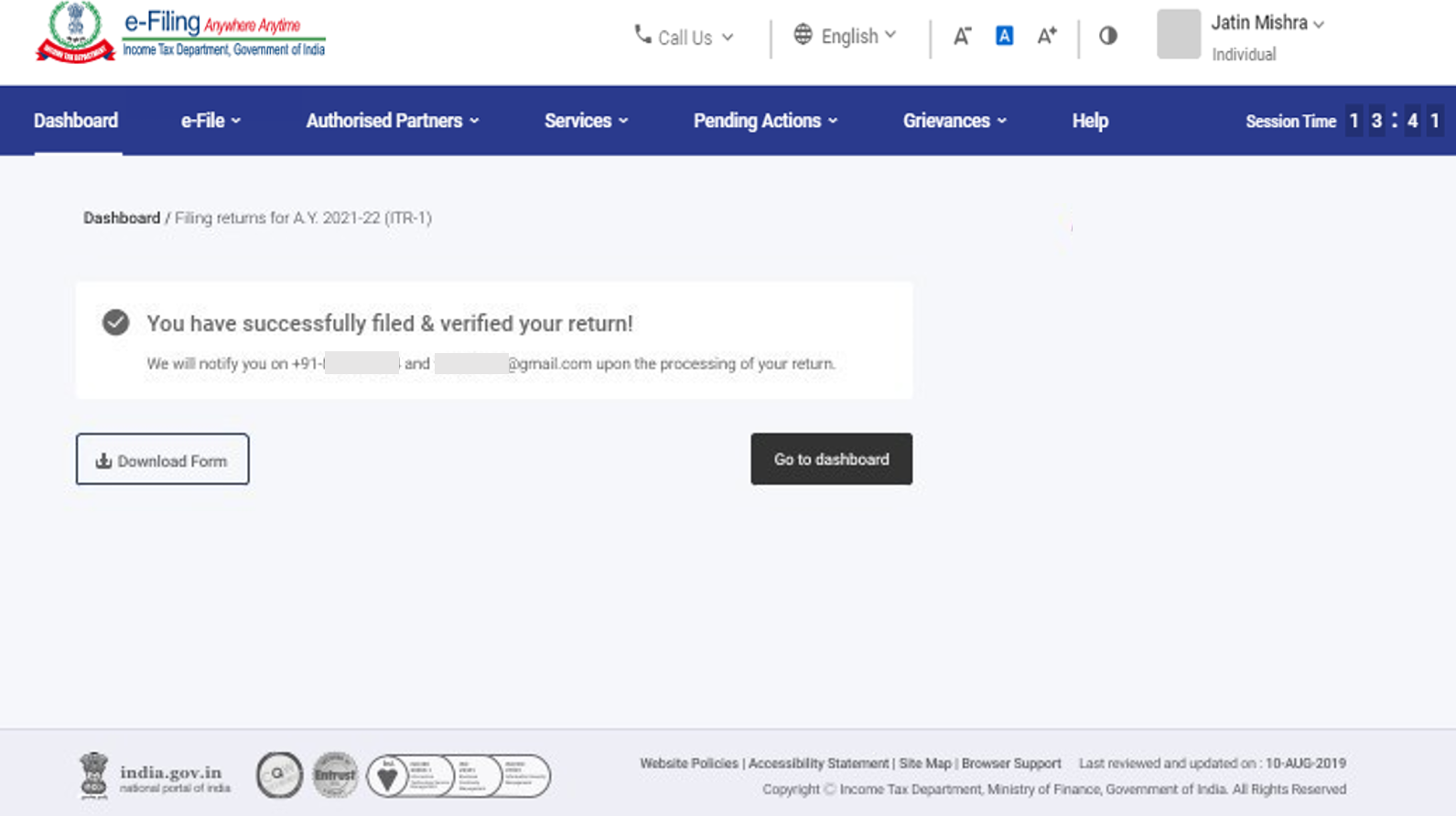

Once you e-Verify your return, a success message is displayed along with the Transaction ID and Acknowledgment Number. You will also receive a confirmation message on your mobile number and email ID registered on the e-Filing portal.

4. Related Topics

Important:-For better result always use google cromeNote:-Please Always Check and Conform Above Details with The Official Website and Advertisement / Notification.

0 Comments:

Post a Comment