PAY POSTEL LIFE INSURANCE (PLI) FOR GOVERNMENT EMPLOYEES

PAY PLI ONLINE || SHOW HISTORY || DOWNLOAD REACIPT || POSTEL LIFE INSURANCE || ONLINE PAY || SHOW UR POLICY || CHANGE PERSONAL DETAILS || GOVERNMENT EMPLOYEES

PAY POSTEL LIFE INSURANCE (PLI) FOR GOVERNMENT EMPLOYEES

Gov. Employee Can Start Own Pli - Online , Pay premiam, Transetion etc..

If u are Government employee. And u have PLI (. Postel life insurance). But u have a problem . U not any time pay primiam at post office for ur work. And many time u have late to primiam. And charge extra money. So sad.

But i have a solution.

I have ans. U become ur policy (PLI) online transaction start now.

How To Pay PLI Online ?

The establishment of Postal Life Insurance (PLI) goes all the way back to pre-independent india. PLI was founded in the year 1884 as a State Insurance scheme for the employees of the postal deoartment. In the year 1888, the scheme was extended to cover employees of the telegraph department as well. However, today, PLi schemes are not only restricted for empioyees of the postal and telegraph departments. It can be bought by individuals working in public sector companies. Covernment organisations, banks and financial institutions, educational institutions, etc.

TABLET SAHAY YOJANA 2022 Namo Tablet

Postal Life Insurance PLI Central Processing Centre PLI T online Primium Postal Life Insurance offers a range of traditional insurance plans which promise a guaranteed benefit. The premiurms under the plans are very low and affordable and the plans promise attractive bonus earnings pli agent login.online pli generate id pli online payment by using credit card.pli online payment kaise kare.pii app.pli customer care postal life insurance for government employees.rural postal life insurance,pli online paytrient by using crcdit card.pli online payment kaiso kare.pli custormer care.pli agent login,how to pay pli premium oniine in telugu,how to update email id in pli,pli calculator.

Given the wide range of insurance plans offered by Postal Life Insurance and their respective benefits, many individuals opt for one or more PLI plans. The planis can be bought from any of the nearest post offices If yau have applied for any plan and want to check the status of your application, the same can be done online, Here's how you can check your postal life insurance online payment

POSTAL LIFE INSURANCE CENTRAL PROCESSING CENTRE India Pat Pay PLI Premium ONLINE

Postal Life Insurance (PLI):

Employees of the next Organizations are eligible main Government, Defence Services, Para Militery forces.

confusion Government, inhabitant Bodies Government-alded instructive Institutions cache depository of India, community Sector Undertakings, economic Institutions, state Banks, self-directed Bodies, addition Departmental Agents in branch of Posts Empioyees Engaged/ Appointed on pact core by centrai/ affirm management someplace the get is extendable, Employees of altogether scheduied industrial Banks.

Employees of believe Co-operative Societies and other Co-operative Societies registered with control under the Co-operative Societies operate and to a certain extent or completely funded from the Central/ affirm Government/RBI/ SBi/ public sector Banks/ NABARD and other such institutions notified by Government, Employees of deemed Universities an edifying institutes ascribed by professional bodies such a nationwide Assessment and Accrecitation council, altogether India congress of mechanical Education, health association of india etc.,

Whatsapp Swa-Mulyankan test 2.0 std 3 yo 10

Employees (teaching/non ideas stafl) of each and every one secretive didactic institutions/schools/colleges and so on affiliatedi to standard Boards (recognized by Centre/State Government) of Secondary/Senior derivative instruction to be exact CBSE, ICSE, express Boards, launch School, etc. Professionals such as Doctors (inciuding Doctors pursuing put up measure off level courses through ary Govt/Private Hospitals, Residents Doctors employed on contractpermanent footing in any Govt/Private Hospitals etc). Engineers.

PAY POSTEL LIFE INSURANCE (PLI) FOR GOVERNMENT EMPLOYEES

How to Pay PLI Premium Online @indiapost.gov.in- Step by Step Process

> How to Pay Postal Life Insurance PLI Premium Online a www.indiapost.gov.in

- Step by Step Process Visit Postal Departrnent Official Website www.indiapost.gov.in

- Go to POstal Life Insurance.

- Click on Customer Login

- Click on Cenerate Custormer ld

- Submit your Policy Details along withyour Mobile Number and Enail ID

- Customer ID and Link will be sent to your Mail within 24 hours

- Click on the Link sent to your Mail ID and set Password

- With that Custorner ID and Password you can Pay PLI Premiium Online by using Debit/ Credit/ Net Banking

Registration Guidelines

1. What is the link for PLI/RPLI premium payment?

The link to pay premium online for PLI/RPLI policies

https://pli.indiapost.gov.in/CustomerPortal/PSLogin.action

2. What are the pre-requisites to pay PLI/ RPLI policy premium online?

- Valid Email Addresa

- Valid unique mobile number

- Register for PLI/RPLI online services.

3. What are the pre-requisites to Purchase PLI and RPLI policy?

Rural Postal Life Insurance (RDLI):The scheme shall cover al persons, maie or female, who permanently reside in rural areas and are ordinarity residents in India to the exclusion of foreigners and norn-resident Indians providedi they have attained majority.

4. How to register for PLI/ RPLI online services?

> Register Mobile number & email id:

Visit your nearest post office with request in writing for registering mobile number and email address, if not done while taking policy.

> Generating Customer ID:

Only on updation of mobile number and email address, customer will be able to register on the portal on clicking below link

> https://pli.indiapost.gov.in/CustornerPortal/PSLogin.action

> On Clicking on 'Generate Customer ID' button on above page, customer will be taken to the portal page, where customer has to fill some mandatory information such as Policy Number, Sum Assured, Insured First Name, email id etc. After all the mandatory information is filled up. customer will click on submit button, then customer ID will be sent to the registeredi email id of the customer with link for resetting the password.

> Ensure that registered Mobile & Email ID is entered while creating customer ID

5. What is the permissible limit for wrong login attempts?

Permissible limit for wrong login is 3 attempts.

6. Services available in Customer Portal?

Purchase policy/ Premium quote generation-Can be done without registration Below service requests require registeration:

- > Premium payment

- > Repayment of loan

- > Generation of quote ( Loan/surrender)

- > initiation of service request

- > Change premium payemnt frequency

- > Change premium payment method

- > Revival

- > Loan

- > Policy surrender

- > Maturity claim Intimation

- > Survival claim intimation

PAY POSTEL LIFE INSURANCE (PLI) FOR GOVERNMENT EMPLOYEES

7. How to Purchase Policy online?

> Click on the link: https://pli.indiapost gov.in/CustomerPortal/loadQuotePage.action PDF File

> Fill the required information.

> Download the form after filling in all requisite info. Visit nearest Post Office with downloaded form and all required documents or get assistance of the agent by clicking on the following link http:/pl.indiapost.gov.in/CustomerPortal/locateanagent.action

> A. Registering Mobile number & email id:

> B. Generating Customer ID.

In order to allow Customers to view and carry out transactions relating to their Postal Life Insurance/Rural Postal Life Insurance policies on real time basis, generation of Customer ID is a pre-requisite on the Customer Portal' through the link

https.//pli.indiapost.gov.in/CustomerPortal/PSLogin.action

ROJGAR SETU FOR ALL GOV. JOB SEEKERS FIND UT BEST JOB

However. before, generating the Customer ID on the Portal, Customer will have to ensure that his/her Mobile number and email address are updated in the system against the respective policy. Only on updation of mobile number and email address, customer will be able to register on the portal by clicking on 'Generate Customer ID' button at the bottom left on the customer portal page.

On Clicking on 'Generate Customer ID button, customer will be taken to the portal page, where customer has to fill some mandatory information such as Policy Number, Sum Assured. Insured First Name, email id etc. After all the mandatory information is filled up, customer will click on submit button, then customer ID will be sent to the registered email id of the customer with link for resetting the password.

OFIICE WORK EASY IN MOBILE - APP FREE AND ESY

Now your will received a premium receipt No, and you can check your payment detail in payment history option.in next few posts we will check how to obtain duplicate premium receipt and what action taken when transaction failed and amount deducted from your account but premium information not updated.pli agent login,online pli generate id.pli online payment by using.credit card,pli online payment kaise kare,pli app.pli customer care,postal life insurance for government employees,rural postal life insurance,pli online payment by using credit card,pli online payment kaise kare,pli customer care,pli agent login,how to pay pli premium online in telugu,how to update email id in pli.pli calculator.

PAY POSTEL LIFE INSURANCE (PLI) FOR GOVERNMENT EMPLOYEES

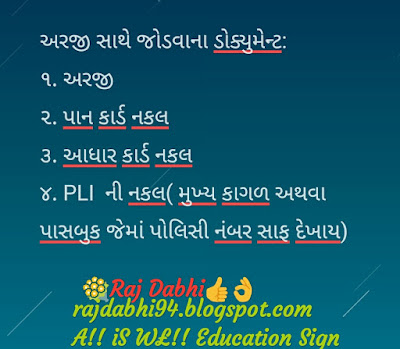

First send this application :-

- I have atteched one word ( document) file in this blog. U have correct ur data and regi. Adi to ur main post office. Means district main post office. Some one email receive u. U have create ur account online.

- Then u not any time problem. U have any time paid ur primiam at online. And no extra charge.

- If u have not eny paper for income tax return for proof for ur pli. But this time u downlod ur online history for payment ur PLI.

- Do you know these things about postal life insurance?

Let's know the special things about this PLI insurance policy:

Start ur PLI online - Application Form

Facility of Postal Life Insurance Plan

However, there are also some conditions:

PAY POSTEL LIFE INSURANCE (PLI) FOR GOVERNMENT EMPLOYEES

IMPORTANT LINK:-

REGISTRASTION કરવા અહીં ક્લિક કરો

PLI ઓનલાઇન ભરવા અહીં ક્લિક કરો

Sumangal scheme of Postal Life Insurance

This plan of Postal Life Insurance (PLI) is known as Sumangal. This insurance plan is a money back policy with a maximum insured amount of Rs 5 lakh.

If you also need some amount from time to time, then you can take this policy. As a subscriber in the Sumangal Plan of Postal Life Insurance (PLI), you get survival benefits from time to time.

DIGITAL DESK FOR ALL STUDENTS ONLINE MATIRIAL, VIDEO, QUIZ, QUIETION BANK ETC.

Such payment is not included in the event of unexpected death of the person purchasing the insurance (PLI). In such a situation, the nominee or legal heir gets the full amount of postal life insurance along with the bonus.

There are two types of policy in this plan of Postal Life Insurance (PLI). One can be purchased for 15 years and another for 20 years. On taking a 15-year policy, the customer gets 20% of the total deposits after 6 years, 20% after 9 years, then 20% after 12 years and 15 years. There is a provision of giving 40% and bonus on completion. 20% after eight years, 20% after 12 years, 20% after 16 years and 40% after 20 years on taking Postal Life Insurance (PLI) policy for 20 years. There is a provision for giving bonus.

During British rule in India, Postal Life Insurance or Postal Life Insurance i.e. PLI was started on 1 February 1884.

Do you know about Postal Life Insurance / Postal Life Insurance (PLI)? It is a life insurance scheme of the Government of India. Actually, the post office sells life insurance policy along with its basic work.

It is included in the country's oldest insurance scheme. During the British rule in India, Postal Life Insurance i.e. PLI was started on 1 February 1884.

If you talk according to the period of launch, then you can consider PLI as India's oldest life insurance plan. Now you can get life insurance up to Rs 10 lakh under Postal Life Insurance (PLI) scheme

Important:-For better result always use google cromeNote:-Please Always Check and Conform Above Details with The Official Website and Advertisement / Notification.

0 Comments:

Post a Comment